Nothing in the NDIS is simple, but understanding how to access consumables and Assistive Technology (AT) can feel next-level complex at times. But you can support participants to access the supports they need and stay compliant by familiarising yourself with the different types of consumables and AT, what evidence is required and how to make claims.

Consumables

Consumables and AT under the NDIS are often talked about together- but they’re not the same thing. Consumables are everyday items people need because of their disability that get regularly used up or replaced. They can include what the NDIA calls disability-related health supports (for example, tube feeding supplies or gauze, bandages, and dressings), as well as items like continence aids. They are always funded in the Core budget under the “Consumables” support category, regardless of cost. Once they’re in a participant’s plan, they don’t need to gather extra evidence before purchasing these items out of their flexible Core budget.

Assistive Technology (AT)

AT is equipment or devices that help a participant do something they couldn’t otherwise do, or couldn’t do as safely, easily, or independently. AT is funded out of different parts of the plan, depending on cost:

Low-cost AT (Under $1,500): funded in Core- Consumables

Mid-cost AT ($1,500–$15,000): funded in Capital- Assistive Technology

High-cost AT (Over $15,000): funded in Capital- Assistive Technology

Evidence for consumables and Assistive Technology

The NDIA has clear rules about what evidence is needed to access different types of Consumables and Assistive Technology (AT). This is important to get across because there’s a lot of misinformation out there, and it’s not unusual for Plan Managers to refuse payment based on “missing evidence” when no evidence is actually required. Or for people to waste time and resources gathering unnecessary documents.

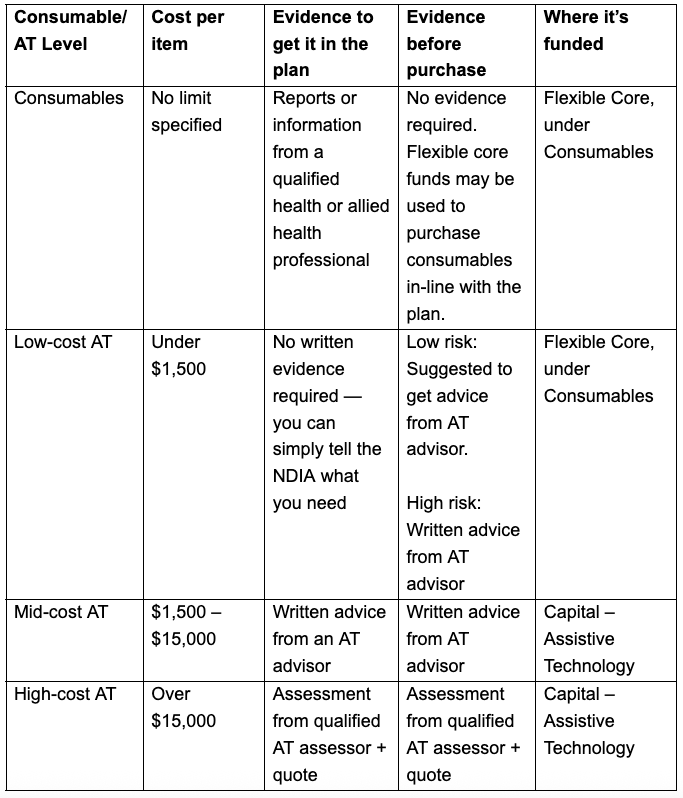

Below is a summary of the evidence requirements for each category. Source: Understand assistive technology evidence, advice, assessments and quotes

Source: Understand assistive technology evidence, advice, assessments and quotes

Source: What evidence do you need to give us before we create or change your plan?

Low-Cost AT: Low risk vs high risk

As you can see in the table above, within the low-cost AT category, the risk level determines what evidence a person needs before purchase. So how are low risk and high risk defined?

- Low risk: AT that is simple, safe to use without specialised set-up. Examples: basic shower chairs, over-toilet frames, long-handled sponges, non-slip bath mats, basic kitchen aids (jar openers, kettle tippers), etc.

- High risk: AT that could cause harm if used incorrectly, needs set-up or adjustment, or requires training for safe use. Examples: transfer boards and slide sheets, pressure cushions for wheelchair users, standing frames, complex walkers with brakes, hoists or lifting equipment, etc.

Source: NDIS AT Product Risk Table

Mid- and High-Cost AT: Capital rules

There are also different rules for purchasing AT depending on whether it is mid- or high-cost.

- Mid-cost AT ($1,500–$15,000)

- Often listed in the plan with a price range.

- The person must buy the specified item before they can use the leftover funds flexibly.

- Requires written advice from an AT advisor before purchase.

- High-cost AT (over $15,000)

- “Stated” in the plan – the person can only purchase the specific item prescribed.

- Requires both an assessor’s report and a quote.

- Delivery, set-up, and adjustment costs must be included in the original quote. Ongoing maintenance and repairs are funded separately (more on this later).

Claiming

The way to claim for consumables and assistive technology (AT) depends on whether it’s low-cost, mid-cost, or high-cost.

Consumables and low-cost AT are claimed from the Core - Consumables budget using notional unit pricing. This method applies to items without a set price limit. Each claim uses a unit price of $1.00, with the number of units matching the dollar value of the purchase. For example, if you buy something for $75, you claim 75 units at $1 each.

Mid-cost AT sits in the Capital - Assistive Technology budget and doesn’t require a quote. The NDIA sets a price limit for each item which is intended to cover more than 80% of claims for that type of support. If the participant needs something that exceeds this limit, the additional amount can be claimed using an AT Supplementary Charge code. This code must:

- Be in the same registration group as the main AT item.

- Only cover the outstanding balance, not the full cost.

- Use the same $1.00 notional unit price as low-cost AT.

Keep in mind:

- The combined total of the main AT item and the supplementary charge must be within the participant’s Capital (AT) budget.

- The participant (or their nominee) must agree to the supplementary charge and follow any plan instructions about the type of AT and its typical price range.

High-cost AT requires a quote. The NDIA must approve the quote, and the item must appear as a “stated” support in the participant’s plan. Once approved, a service booking is automatically created, and the person will receive a MyPlace Inbox notification. In most cases, the item must be purchased and delivered before claiming, but there are exceptions for prepayments.

Prepayments are allowed for certain high-cost supports where:

- The item is valued at more than $1,500 or is custom-made for the participant.

- A valid quote has been accepted.

- The service agreement sets out the deposit or milestone payments.

- The final payment (at least 10% of the cost) is only claimed once the participant has the item ready for use.

- The support is either listed as eligible for prepayment in the Pricing Arrangements or has written NDIA approval.

Prepayments should only be used where the provider would otherwise face unrecoverable costs if the order doesn’t proceed - for example, a custom-made wheelchair. If the order is cancelled, the participant is entitled to a refund of unused funds (minus genuine unrecoverable expenses) and retains their full rights under Australian Consumer Law.

In/Out Lists and Low-Cost AT

The new In/Out lists, rolled out in October 2024, have reshaped what can and can’t be bought with NDIS funds - but not always in ways that feel fair or flexible. The new Act promised certainty about what can be purchased, but in practice, there’s still ambiguity. And while the NDIA’s advice is usually “ask your LAC, ECEI partner or Support Coordinator,” the truth is that all too often, no one actually has the answer. Consumables and low-cost AT are no exception. These lists are now the first test in deciding whether an item can be purchased with NDIS funds.

If an item appears on the out list - it can’t be purchased using NDIS funds, even if it otherwise seems reasonable and necessary - unless it qualifies as a replacement support. There are only five types of supports that can be considered as replacement supports: standard commercially available household items, smart watches, tablets, smartphones and an app used for accessibility or communication purposes.

My brilliant colleague Chris wrote an article about replacement supports: NDIS Act Explained: Replacement supports

Maintenance and repair

Let’s face it, everyday life can be tough on the equipment people rely on. Cushions get soiled, batteries wear out, sooner or later most AT needs a tune-up. How the NDIS covers these repairs depends on the price tag and the kind of fix required.

- The NDIA includes funding in the Capital - AT budget for repairs and maintenance of items costing more than $1,500.

- Repairs covered by supplier or manufacturer warranties (including under Australian Consumer Law) must be taken up directly with them and are not considered “reasonable and necessary” supports.

- Minor repairs costing less than $1,500 and outside the warranty period should generally be claimed as a low-cost AT item under Core - Consumables. This is the most flexible option, although participants can also use unallocated Capital - AT funds if available.

- For repairs costing more than $1,500, funding is usually provided through a quotable Repairs and Maintenance support item in the participant’s plan. These are linked to the relevant AT category and can be claimed once the participant agrees to the work.

Most repairs and maintenance items are not subject to a price limit. They also use the notional unit pricing method - claiming the number of $1 units equal to the dollar value of the repair.

Where the complexity kicks in

Sorting out whether something is consumables, low-cost AT, mid-cost AT or high-cost AT is the easy part. The real circus begins when you try to claim it. You can tick every box and line up all the paperwork, but the decision often still turns on interpretation. Risk classification, plan wording, and the new In/Out list all get thrown into the mix - which means even an obvious disability-related need isn’t always a sure thing.

Recent Administrative Appeals Tribunal cases are already shedding light on how the NDIA is likely to apply these rules - and in some cases, the outcomes have been different from what providers and participants expected.

If you’re keen to better understand the new rules in practice (as they evolve) check out our new workshop - Claiming Consumables and Low-Cost AT: The New Rules in Practice - where we will:

- Unpack the latest Tribunal cases and their implications for AT purchases.

- Explore how to frame requests to improve your chances of getting funding approved.

- Work through tricky, real-world examples together.

Details and registration: Claiming Consumables and Low-Cost AT: the New Rules

:format(jpg))